XOILAC tv - TRỰC TIẾP KẾT QUẢ BÓNG ĐÁ XOILACTV #1

Xoilac TV được đánh giá là một trong những trang web xem bóng đá nổi bật trên thị trường trực tuyến. Hiện nay, người chơi có thể thử sức với các kèo cược có tỷ lệ tiền thưởng vô cùng giá trị. Hãy cùng tìm hiểu ưu điểm khi bạn lựa chọn địa chỉ này nhé.

Đôi nét giới thiệu tổng quan về trang xem bóng đá Xoilac TV

Xoilac TV luôn được biết đến là một kênh xem bóng đá trực tiếp vô cùng chất lượng. Khi tham gia vào địa chỉ này, bạn được thoải mái xem những trận đấu cuốn hút nhất mà không lo bị gián đoạn.

Ngoài ra, đây cũng là một trong những trang web cung cấp các tin tức bóng đá chuẩn xác để bạn có thể làm cơ sở soi kèo cho mình. Những thông tin tại đây đều đã được kiểm duyệt trước khi đăng tải, vì vậy người chơi hoàn toàn yên tâm.

Với những tin tức hữu ích về bộ môn bóng đá, hiện nay trang web đang trở nên phổ biến hơn rất nhiều và được lượng lớn người hâm mộ truy cập mỗi ngày. Chính vì vậy, nếu bạn đang muốn tìm kiếm các thông tin về bộ môn này hãy theo dõi tại đây nhé.

Sứ mệnh và mục tiêu của Xoilac TV

Xoilac TV được thành lập và hoạt động trên thị trường với những phương châm, sứ mệnh và mục tiêu riêng. Họ luôn đảm bảo quyền lợi của những người hâm mộ bóng đá trong trải nghiệm xem bóng hoặc cá cược.

Sứ mệnh chính của Xoilac TV

Hiện nay trên thị trường trực tuyến có nhiều trang web cung cấp các thông tin và link xem bóng tuy nhiên thường xuyên gặp gián đoạn. Chính vì vậy, với sứ mệnh mang đến trải nghiệm theo dõi bóng đá cho người chơi trọn vẹn nhất, Xoilac TV đã ra đời.

Đơn vị luôn hướng đến việc cung cấp các thông tin bóng đá nhanh nhất và chính xác, đầy đủ nhất. Điều này sẽ giúp giảm thời gian hội viên phải tìm kiếm tin tức ở nhiều nơi, tăng trải nghiệm khách hàng hơn.

Mục tiêu phát triển của trang web này

Mục tiêu phát triển của đơn vị đó là trở thành trang web cung cấp thông tin bóng đá và link xem các trận đấu hàng đầu trên thị trường. Mang đến những trải nghiệm nhờ link chất lượng cao, tránh các tình trạng link bị gián đoạn.

Ngoài ra, đơn vị cũng đang chuẩn bị hợp tác với thêm nhiều sảnh cược bóng đá nổi tiếng có sự uy tín cao để giúp người chơi bảo vệ quyền lợi của mình khi tham gia. Trang web luôn mong muốn nhận được sự tin tưởng và hài lòng từ phía khách hàng của mình.

Ưu điểm nổi bật đáng chú ý của trang xem bóng uy tín

Xoilac TV luôn được nhiều chuyên gia đánh giá cao bởi có nhiều ưu điểm nổi bật nhất. Chính vì vậy, bạn hãy theo dõi trang web này khi có nhu cầu tìm hiểu các tin tức bóng đá chuẩn xác. Dưới đây là một vài điểm ấn tượng hàng đầu của địa chỉ này.

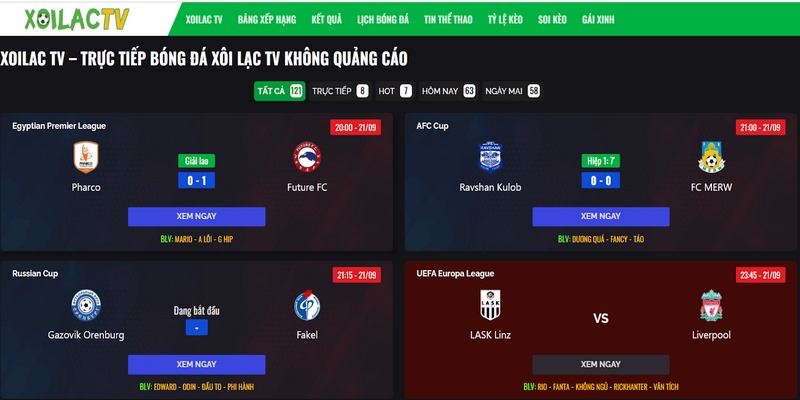

Trải nghiệm xem các trận đấu bóng đá không gặp quảng cáo

Hiện nay trên các trang trực tuyến có nhiều địa chỉ cung cấp link xem bóng cho người hâm mộ. Tuy nhiên không phải trang nào cũng miễn phí, thông thường bạn sẽ phải trả một số tiền nhất định để trải nghiệm xem không gặp gián đoạn.

Tuy nhiên, đơn vị được thành lập và cung cấp cho người hâm mộ bóng đá những đường linh xem bóng miễn phí. Đặc biệt, trong quá trình theo dõi không hề xuất hiện các tin tức quảng cáo khiến gây rối mạch xem. Chính vì vậy, đây chắc chắn sẽ là một địa chỉ mà bạn nên tham khảo ngay.

Xem bóng với chất lượng hình ảnh sắc nét

Có thể nói, trang web luôn đảm bảo mang đến cho hội viên những đường link xem bóng chất lượng với độ phân giải cao. Đặc biệt, đơn vị cũng lấy nguồn từ những phóng viên có mặt trực tiếp tại sân để giúp bạn nhìn rõ được từng chi tiết tình huống trong mỗi trận.

Hệ thống âm thanh kết hợp mượt mà, chất lượng

Bên cạnh việc hình ảnh xem bóng cực rõ nét thì đơn vị cũng luôn đảm bảo người hâm mộ được trải nghiệm hệ thống âm thanh chất lượng và ấn tượng. Trong thời gian bạn theo dõi sẽ không bỏ qua bất kỳ tình tiết nổi bật nào.

Mọi thông tin liên quan đến trận đấu sẽ được chỉ ra rõ nhờ hệ thống âm thanh. Các lời nói của bình luận viên cũng dễ nghe mà không hề bị rối với tiếng trong trận đấu nên bạn không cần lo lắng.

Đội bình luận viên chuyên nghiệp tại trang xem bóng

Hiện nay, Xoilac TV đang có đội ngũ bình luận viên vô cùng chuyên nghiệp giúp người hâm mộ nắm rõ từng chi tiết của trận đấu. Các admin này đều là những chuyên gia có kinh nghiệm và kiến thức về bộ môn bóng đá, đảm bảo hiểu rõ luật và nắm bắt các tình huống nhanh chóng.

Nhờ vào sự chuyên nghiệp dẫn dắt thông tin trận đấu của các bình luận viên, dù bạn là người mới tìm hiểu xem bóng cũng dễ hiểu hơn. Hơn nữa, họ cũng mang đến nhiều cung bậc cảm xúc từ hài hước đến kịch tính cho người theo dõi.

Cộng đồng Fan của Xoilac TV rất đông

Cộng đồng fan của Xoilac TV hiện nay đang rất đông và đều là những người yêu thích bóng đá lâu năm. Nếu bạn mới bắt đầu tìm hiểu về trang web này, hãy tham gia ngay để được nắm bắt thêm nhiều tin tức vô cùng thú vị.

Xoilac TV bảo mật thông tin của người theo dõi

Một trong những ưu điểm hàng đầu của trang web đó là tính bảo mật thông tin tuyệt đối. Đơn vị cam kết không sử dụng các dữ liệu khách hàng trong bất kỳ tình huống hay mục đích nào, đặc biệt là đi thương mại với bên thứ ba.

Sau khi bạn truy cập vào đường link trang web, đơn vị sẽ sử dụng hệ thống bảo mật thông tin của mình để mã hóa và lưu trữ trong hệ thống an toàn nhất. Chính vì vậy, bạn sẽ không cần lo lắng những dữ liệu cá nhân bị lộ.

Highlight trận đấu với nội dung trọn vẹn ấn tượng nhất

Tại trang xem bóng chất lượng cũng thường xuyên cung cấp những highlight trận đấu để những ai không theo dõi trực tiếp có thể xem lại. Đây cũng là một trong các cơ sở chuẩn nhất để bạn đánh giá phong độ đội bóng và soi kèo các trận về sau.

Lịch thi đấu các mùa giải bóng đá rõ ràng

Trang web này cũng liên tục cập nhật lịch thi đấu bóng đá một cách rõ ràng. Chính vì vậy bạn sẽ không bao giờ bị bỏ lỡ những trận bóng hay trong một mùa giải cụ thể dù không có thời gian theo dõi.

Bảng thông tin bóng đá cập nhật nhanh nhất trong 24/7

Tại trang web này, các admin đã xây dựng một bảng cập nhật thông tin và kết quả bóng đá 24/7. Nhìn vào đây, bạn có thể thấy rõ những tin tức quan trọng trong một mùa giải.

Cập nhật tin tức bóng đá nhanh nhất từ nguồn uy tín

Hiện nay, trang web này cũng đảm bảo cung cấp các tin tức bóng đá nhanh nhất và chuẩn nhất. Các thông tin được cập nhật tại đây để người đọc theo dõi đều đến từ những nguồn đáng tin cậy hàng đầu.

Xoilac TV và giải đáp những câu hỏi thắc mắc

Xoilac TV hiện nay đang là một trong những địa chỉ xem bóng và cập nhật tin tức bóng đá chuẩn xác. Hãy cùng giải đáp những câu hỏi được nhiều người thắc mắc nhất thời gian qua.

Làm cách nào để dễ tìm kiếm thông tin tại đây?

Trên trang cung cấp rất nhiều nội dung khác nhau liên quan đến từng mùa giải. Tuy nhiên, vì nhu cầu tìm kiếm thông tin của mỗi người là khác nhau, vì vậy, trước tiên bạn nên xác minh danh mục cần tìm là gì.

Sau đó, bạn sẽ tìm kiếm, tin tức của mình một cách nhanh chóng mà không cần phải truy cập từng danh mục. Đây là một phương pháp tiếp cận nội dung phù hợp mà bạn không nên bỏ qua.

Quy định về việc chia sẻ những thông tin tại đây là gì?

Các nội dung được chia sẻ trên trang này đều đảm bảo từ những nguồn đáng tin cậy. Mặc dù đơn vị không nghiêm cấm việc đưa những thông tin này lên trang mạng xã hội nhưng bạn vẫn phải đảm bảo sử dụng một cách hợp lý.

Đơn vị yêu cầu bạn sử dụng thông tin tại trang Xoilac TV trong công việc tốt, tránh dùng trong các mục đích xấu, trục lợi cá nhân hoặc lừa đảo khách hàng. Ngoài ra, khi bạn chia sẻ nội dung cần phải ghi rõ nguồn của trang web.

Xoilac TV có mất phí khi sử dụng thông tin không?

Các thông tin được chia sẻ tại trang web này đều đảm bảo miễn phí và người theo dõi không cần trả thêm bất kỳ khoản phí nào. Chính vì vậy, bạn có thể hoàn toàn yên tâm trong trải nghiệm của mình để nắm bắt tin tức trận đấu.

Ngoài ra, cũng cần phải lưu ý về việc truy cập đường link chính thức của Xoilac TV. Trong trường hợp bạn bị yêu cầu phải nạp tiền vào tài khoản để xem bóng thì chắc chắn đó là link lừa đảo.

Trang website này có bị giới hạn địa chỉ IP không?

Trang website không bị giới hạn về địa chỉ IP vì đây là một địa chỉ uy tín, được phép hoạt động công khai trên thị trường. Ngoài ra, tại sân chơi này bạn sẽ được cung cấp nhiều thông tin thú vị về bóng đá và theo dõi các tin tức hot nhất về các giải đấu.

Chính vì vậy, không có chuyên trang web này giới hạn địa chỉ IP của người dùng. Trong trường hợp bạn không thể truy cập vào đường link chính thức, điều này thường có nguyên nhân là do bạn vào lúc khung giờ vào có quá nhiều người đăng nhập khiến link bị gián đoạn.

Trận đã đấu diễn ra có thể xem lại tại đây không?

Tại trang web này, bạn không chỉ được xem trực tiếp các trận bóng đang diễn ra mà có thể theo dõi lại những trận cầu nổi tiếng trước đó một cách đơn giản. Đơn vị sẽ để link riêng tại một danh mục nên bạn sẽ tìm kiếm nhanh chóng.

Ngoài ra, trang web cũng sẽ cung cấp thêm những video highlight của trận đấu, đây đều là những khoảnh khắc nổi bật trong 90 phút diễn ra. Chính vì vậy, bạn sẽ thấy được những tình tiết ấn tượng nhất.

Kết luận

Trên đây là những thông tin hấp dẫn liên quan đến Xoilac TV mà mọi người không nên bỏ qua. Đây là một địa chỉ xem bóng ấn tượng, chính vì vậy bạn hãy tham khảo ngay để theo dõi và cập nhật thêm những tin tức hot nhất về các đấu lớn hàng đầu trên toàn thế giới.